us germany tax treaty protocol

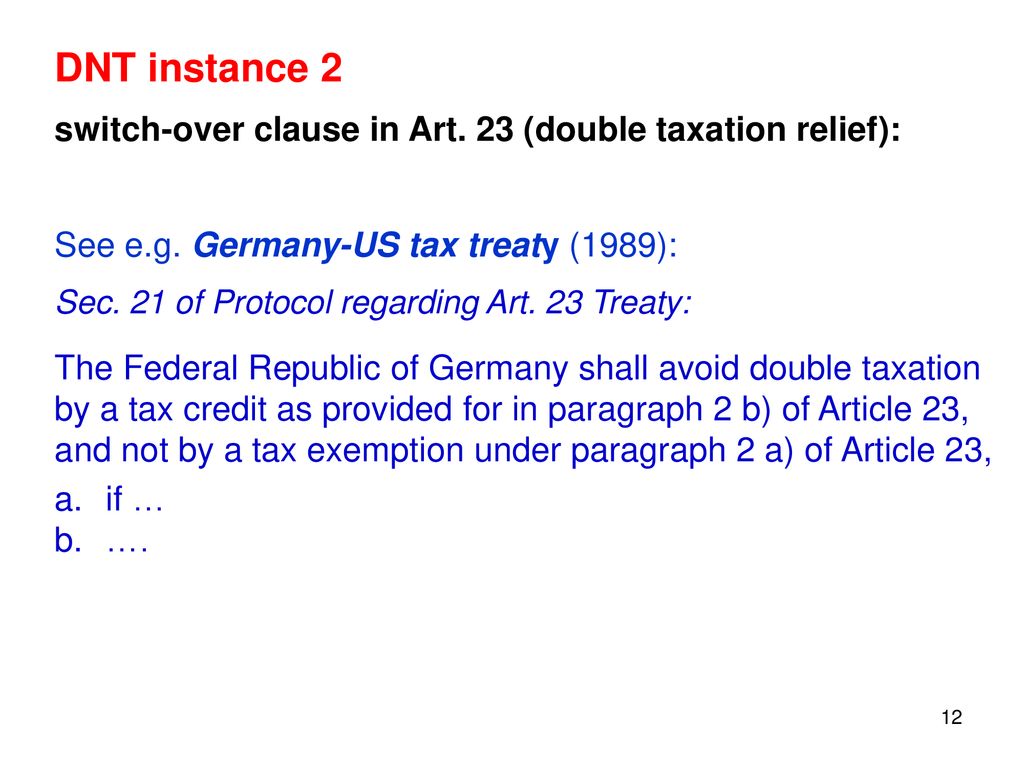

Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with. The Text shows the Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation with Respect to Taxes on.

German Law Removes Us S Corporation Tax Benefit

The treaty has been updated and revised with the most recent version being 2006.

. 104 rows The texts of most US income tax treaties in force are available here. The tax treaty prevents on the one hand double. On March 24 2021 the Netherlands and Germany signed a protocol to amend the tax treaty between the two states the Protocol.

On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the Existing. Once in force the new treaty and protocol will replace the. Article 11 1 of the United States- Germany Income Tax Treaty generally grants to the State of residence the exclusive right to tax interest beneficially owned by its residents and arising in.

Protocol Amending the Convention Between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the. The complete texts of the following tax treaty documents are available in Adobe PDF format. On 27 November 2006 a new income tax treaty and related protocol between Belgium and the United States was signed.

The purpose of the. B The decedents surviving spouse was at the time of the decedents death domiciled in either. Germany and the United States have been engaged in treaty relations for many years.

Republic of Germany or the United States of America. If you have problems opening the pdf document or viewing pages download the latest version of. The German Federal Ministry of Finance BMF in January 2022 provided information on the current status of Germanys network of income tax treaties and treaty negotiations in.

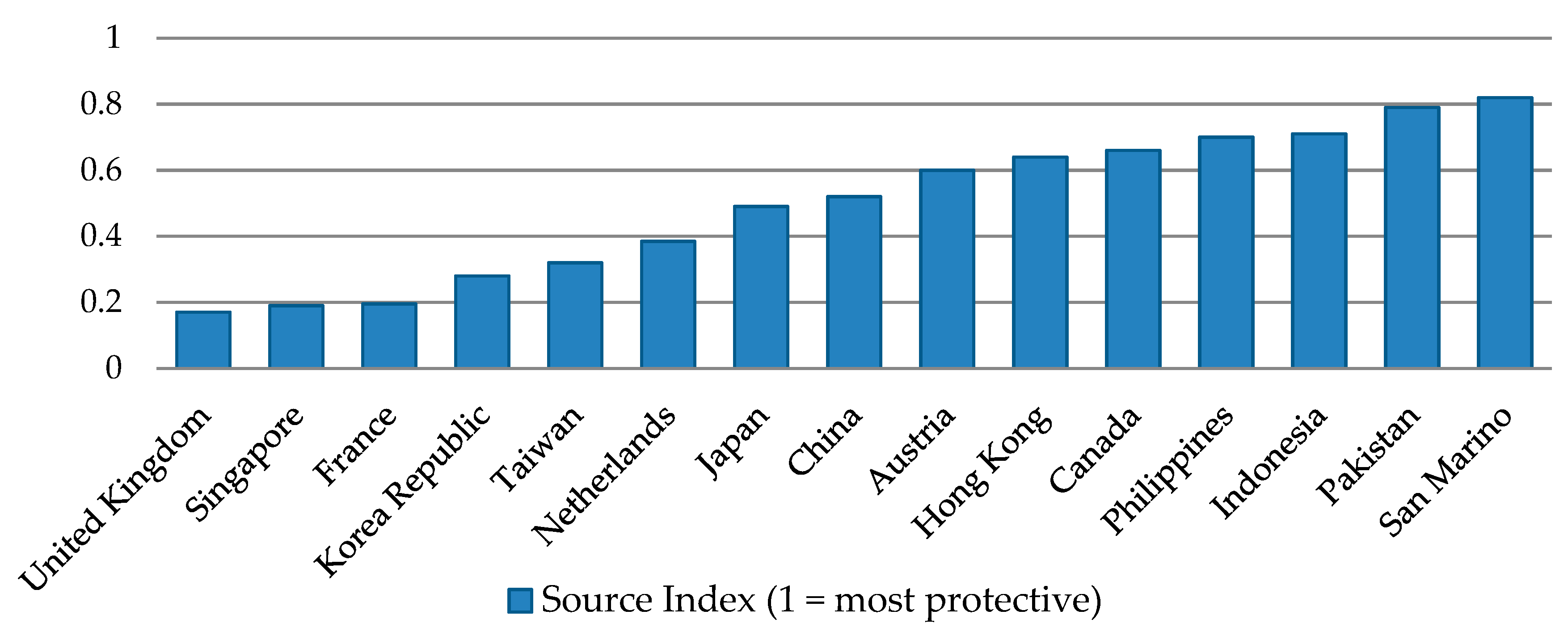

Jrfm Free Full Text Double Taxation Treaties As A Catalyst For Trade Developments A Comparative Study Of Vietnam S Relations With Asean And Eu Member States Html

Germany United States International Income Tax Treaty Explained

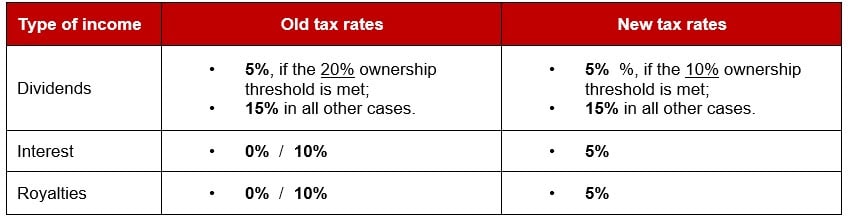

The Protocol Amending The Ukraine Switzerland Double Tax Treaty Entered Into Force

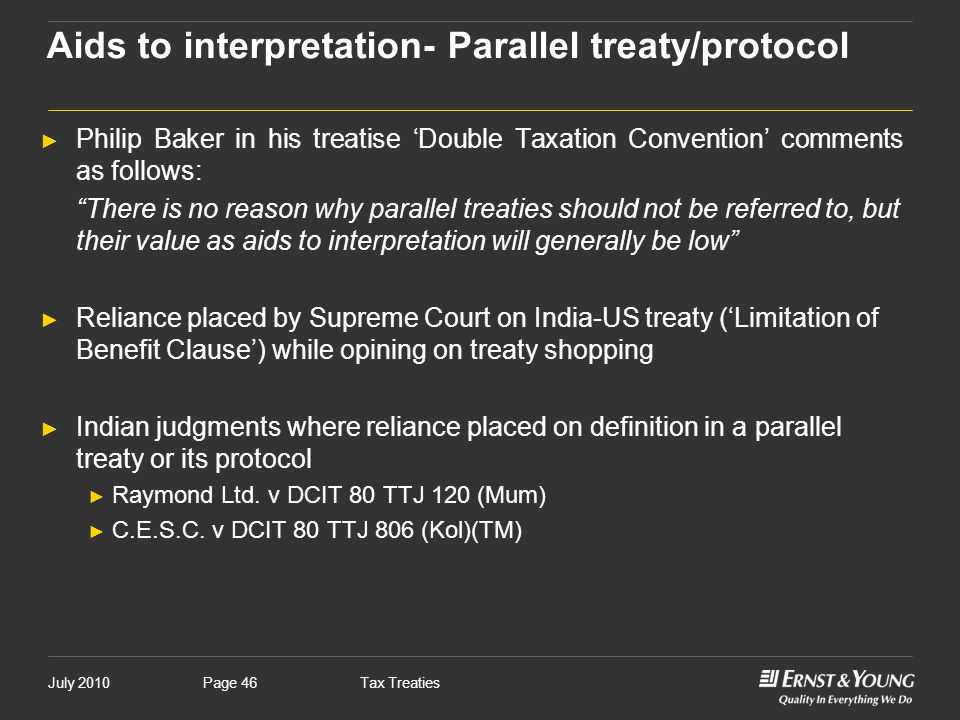

Tax Treaties International Scenario And India Relevance Amarpal S Ppt Download

Warning On Germany France Double Tax Treaty Changes Refire

Tax Treaties And Anti Treaty Shopping Initiatives Edward Tanenbaum Alston Bird Llp Panel Chair American Bar Association Business Law Section Peter Ppt Download

Convention On Mutual Administrative Assistance In Tax Matters Oecd

What Is The U S Germany Income Tax Treaty Becker International Law

Spanish Taxes For Us Expats Htj Tax

The General Treaty Provisions That All Individual Foreign Investors Should Consider Before Investing In The United States Sf Tax Counsel

New Protocol To The Uk Germany Double Tax Treaty Signed Kpmg United Kingdom

Iatj 2014 Conference Double Non Taxation Under Tax Treaties Ppt Download

Germany Specific Tfx User Guide

Taxnewsflash Europe Kpmg United States

Multilateral Convention To Implement Tax Treaty Related Measures To Prevent Base Erosion And Profit Shifting Wikipedia

Us Taxes For Us Exposed Persons In Spain Htj Tax

Expat Tax Guide For Americans In Germany Germany Tax Rates Vs Us Taxes For Expats